OpenAI, a San Francisco-based artificial intelligence research organization, has been making headlines with its groundbreaking language model GPT-3, ChatGPT, and various applications in AI technology. Led by the owner Sam Altman, the company is at the forefront of developing cutting-edge AI solutions, including generative pre-trained transformers (GPT), DALL-E, Whisper, and Llama.

As investors eagerly anticipate the potential to invest in OpenAI, it’s essential to become familiar with the organization’s business model, market influences, and future outlook. Therefore we have summarized the most important information for you below.

As an AI-driven company, OpenAI’s current focus is on enhancing its language models and technologies to revolutionize various industries, such as gaming, finance, and healthcare. Innovative applications like ChatGPT, which is widely used for customer support, content generation, and code completion, showcase the potential of artificial intelligence in a broad array of sectors. Furthermore, OpenAI is collaborating with industry leaders to build practical applications of AI technologies and ensure their safe and responsible development.

Although OpenAI is not yet publicly traded, the company’s valuation has rapidly increased, tapping into the growing interest in AI investment. Investors are keen to gain exposure in this expanding sector, and OpenAI is considered a key player with its ambitious mission to ensure that artificial general intelligence (AGI) benefits all of humanity.

On This Page

Important Takeaways for now:

- OpenAI leads AI research with their GPT-3 model and various applications, such as ChatGPT and DALL-E

- The company works on multiple innovative AI solutions across different industries, emphasizing safety and responsibility

- Though not publicly traded, OpenAI’s growing valuation reflects the high interest and potential for AI investments

OpenAI’s Business Model

Major Technologies and Advances

OpenAI has been at the forefront of AI research, with its primary focus being on developing state-of-the-art models like GPT-4. GPT-4 continues to showcase improvements in natural language understanding and generation, offering a wide array of potential applications. The model has already been integrated into various businesses, including Microsoft’s Bing search engine, which harnesses its capabilities to enhance user experience.

Do you already know our free ChatGPT 4 Access?

Partnerships and Collaborations

Collaboration is a crucial aspect of OpenAI’s growth strategy. The organization has entered partnerships with industry giants like Microsoft, utilizing the Azure cloud platform to boost AI research and development. Microsoft’s Azure provides OpenAI with the necessary infrastructure to train and deploy their models, while the company leverages OpenAI’s expertise for better AI integration in its services.

Another notable collaboration is OpenAI’s partnership with Anthropic, a startup focused on AI safety and alignment. Both organizations are committed to building AI systems that are safe and beneficial to humans, emphasizing transparency and accountability.

Revenue Generation

Transitioning from a non-profit to a for-profit business model, OpenAI aims to generate revenues by implementing a range of strategies. One such approach involves offering API access to its technologies, allowing businesses and developers to incorporate OpenAI’s AI models into their applications. This move is expected to create a reliable revenue stream while expanding the technology’s real-world applications.

Moreover, OpenAI’s rapid advancements in AI technology, coupled with valuable partnerships and collaborations, have significantly increased its market value. With talks of a potential share sale and a valuation of around $90 billion, investing in OpenAI stock could be an attractive opportunity for those interested in the growing AI industry.

On a final note, OpenAI continues to reinforce its position as a leading AI research institution by driving advances in technology, partnerships, and revenue generation strategies.

Investor’s Corner

Stock Evaluation

OpenAI, the company behind ChatGPT, has been making headlines with its recent talks of selling existing employee shares at an $86 billion valuation. Although OpenAI does not currently trade publicly, interested investors can gain exposure to the company by purchasing shares of Microsoft, which invested $1 billion in OpenAI in 2019. Microsoft has also partnered with OpenAI for various projects, benefiting from the startup’s technology advancements.

Market analysts following OpenAI’s progress have drawn comparisons to other notable technology giants, like NVIDIA. The Wall Street Journal reported OpenAI’s quest for a boosted valuation, which could lead to substantial returns for early investors. As with any investment, monitoring financial markets, relevant news, and SEC filings for Microsoft and other relevant publicly traded companies should be a crucial consideration for potential investors.

Potential Risks and Returns

Investing in stocks or ETFs with exposure to OpenAI carries inherent risks and potential returns. As artificial intelligence becomes increasingly important, businesses heavily involved in the sector, such as OpenAI and NVIDIA, may have considerable growth opportunities. OpenAI has received significant funding from venture capital firms, further solidifying its position in the industry. Meanwhile, the Wall Street Journal has acknowledged the startup’s rapid valuation growth.

Despite the promising outlook, investors should also account for potential setbacks. Market volatility, regulatory changes, and competition within the AI industry can pose risks for investors. Additionally, while OpenAI’s partnership with Microsoft offers exposure to the company’s progress, it is important to remember that Microsoft’s stock price reflects far more than just its involvement with OpenAI.

In assessing the potential risks and returns of investing in OpenAI, it is vital for investors to conduct thorough due diligence and remain up to date with relevant financial news and market trends. Approach investments wisely, and consider seeking advice from finance professionals if necessary.

Market Influences

Competitive Landscape

The AI market has experienced rapid growth, and OpenAI faces strong competition from established tech giants and emerging AI startups. Major players like Google, Meta (formerly Facebook), and Amazon continue to invest heavily in AI research and development. Additionally, AI startups are vying for market share with their innovative solutions, making the competitive landscape more complex.

Notably, SpaceX collaborates with OpenAI and benefits from the synergy between AI and space exploration. Conversely, companies such as ByteDance, the parent company of TikTok, leverage AI-driven algorithms to dominate social media platforms, posing an indirect challenge to OpenAI’s innovative approach in AI technology.

Market Trends

Several market trends contribute to the growing demand for AI products and solutions, impacting OpenAI’s position in the market. Among the significant factors are the expansion of AI applications across various sectors, increasing global investment in AI technologies, and rising interest in cryptocurrencies.

- Sectors: AI technology is penetrating sectors such as healthcare, finance, retail, and more, providing advanced solutions and automating complex tasks. This diversification across industries implies a potential increase in demand for OpenAI’s cutting-edge technology.

- Investment: As AI gains momentum, global investments in AI technologies have surged, creating a lucrative environment for AI companies such as OpenAI. A rapidly growing valuation, exemplified by OpenAI’s recent talks for an $86 billion valuation, attests to increasing investor interest in AI companies.

- Cryptocurrencies: Blockchain and cryptocurrency technologies intersect with AI developments, influencing the market conditions for AI technology providers. As more companies explore applications for AI and decentralized technologies, OpenAI stands to benefit from these burgeoning trends.

Trading on the NASDAQ, OpenAI’s stock performance is also affected by broader market movements. A tender offer by OpenAI could influence its valuation and stock price, further impacted by factors such as investor sentiment, market volatility, and the performance of stocks in the technology sector.

Future Outlook

The future outlook for OpenAI appears promising as the artificial intelligence software company engages in discussions on completing a deal that would value the organization at $80 billion or more. With such a potential valuation, OpenAI stands as a major player in the ever-evolving landscape of AI startups.

As OpenAI progresses, investors are keeping an eye on potential initial public offerings (IPOs) and share sale options. The artificial intelligence company is currently in talks to sell existing employees’ shares at an $86 billion valuation. This move indicates that while a traditional IPO isn’t on the table yet, OpenAI is exploring methods to support its workforce and continue its growth.

Aside from financial matters, OpenAI has garnered attention in news circles for its advancements in AI technology. Its recent development of a chatbot, ChatGPT, has proven crucial to the company’s rising valuation and furthers its position in the Silicon Valley tech ecosystem.

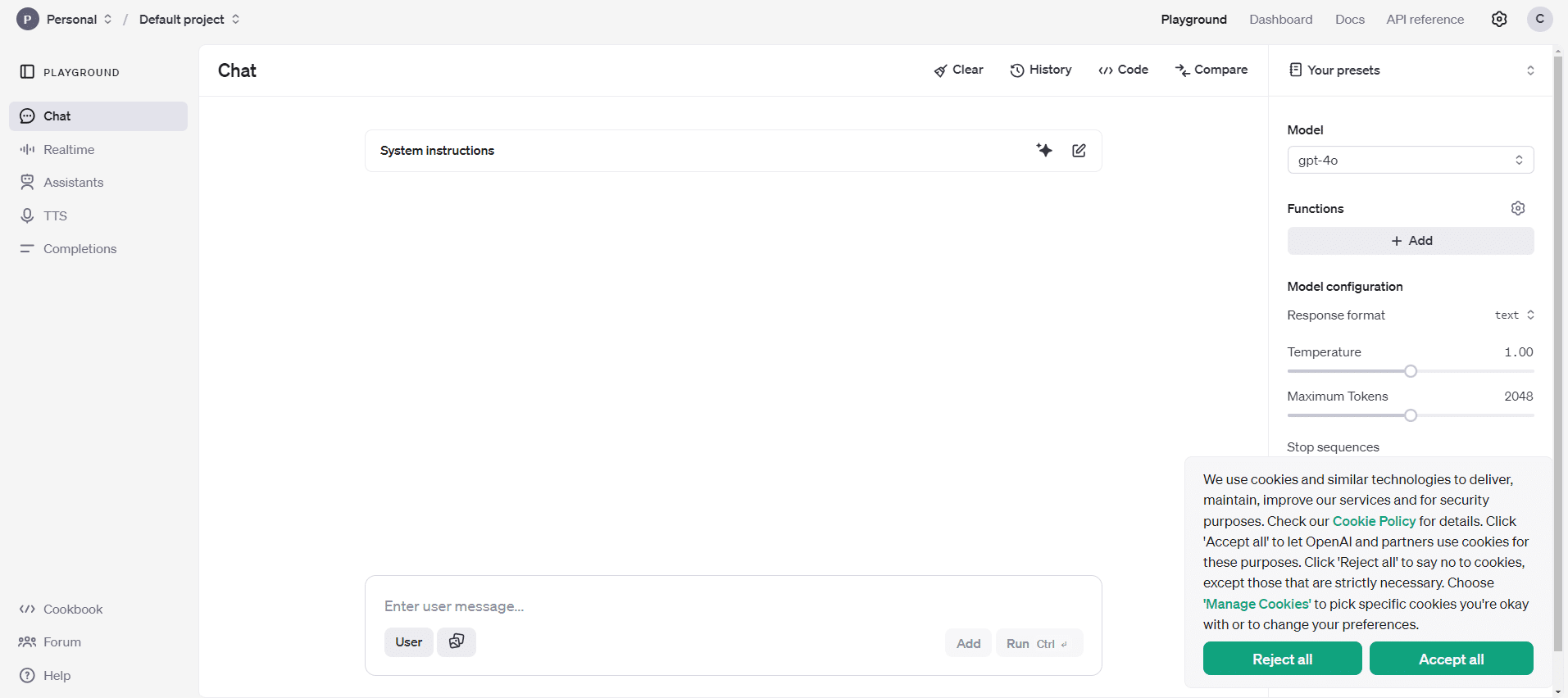

Moreover, as OpenAI continues to innovate and expand its technologies, the company is likely to encounter challenges and opportunities related to browser functionalities, JavaScript integrations, and the implementation of cookies to enhance user experience. Given the increasing importance of data privacy and user consent, OpenAI is expected to adhere to comprehensive terms of service and cookie policies.

To stay ahead in an intensely competitive market, OpenAI will need to work closely with its support team and maintain open channels of communication with clients. Staying informed on industry advancements, technology updates, and market shifts will be fundamental to the AI company’s continued success.

As the world of artificial intelligence continues to evolve, OpenAI’s position as a leading AI startup, its potential future share sale, and its commitment to innovation signify a bright and promising future outlook.